Introduction

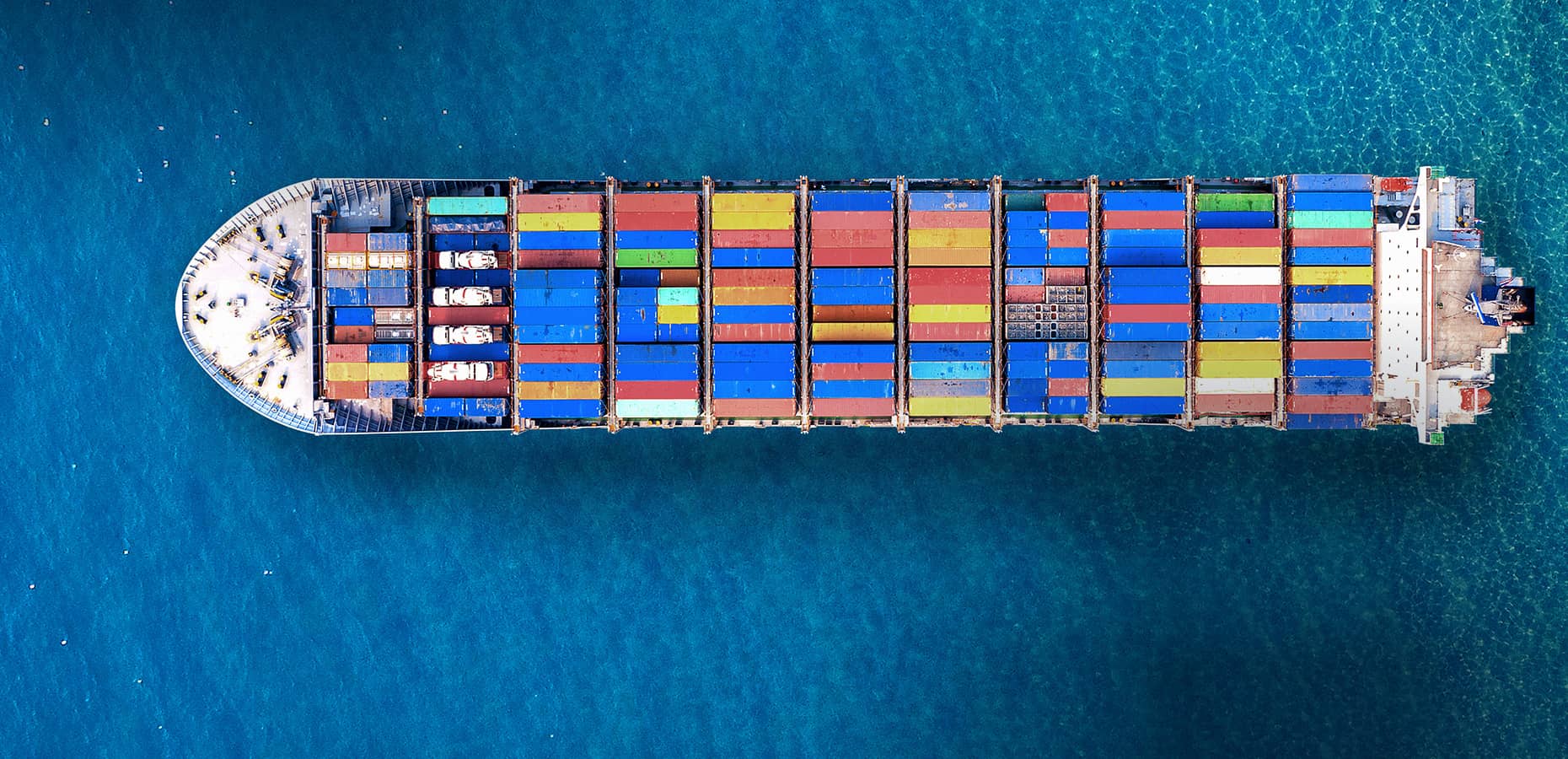

Choosing the right international shipping company is a crucial decision for businesses engaged in global trade. With numerous options available, it can be overwhelming to navigate the complexities of shipping logistics. This guide will provide you with essential insights and strategies to help you make an informed choice that aligns with your business needs.

Understanding International Shipping

International shipping involves transporting goods across borders, requiring compliance with various regulations and standards. Selecting the appropriate shipping company is vital for ensuring timely delivery, cost-effectiveness, and customer satisfaction. The right carrier can significantly impact your supply chain efficiency and overall business success.

Considerations When Choosing an International Shipping Company

When evaluating potential international shipping companies, consider the following critical factors:

- Service Offerings: Assess the range of services provided by the carrier, including air freight, ocean freight, customs clearance, and warehousing options. A comprehensive service portfolio can streamline your logistics operations.

- Experience and Expertise: Look for carriers with a proven track record in handling shipments similar to yours. Their experience in specific industries or types of cargo can be invaluable.

- Pricing Structure: Compare pricing models among different carriers. Ensure that you understand all costs involved, including potential hidden fees, to avoid budget overruns.

- Geographic Coverage: Verify that the shipping company has a robust network that covers your desired destinations. This is especially important for international shipments where local knowledge can facilitate smoother operations.

- Reliability and Reputation: Research the carrier’s reputation for on-time deliveries and overall reliability. Customer reviews and industry ratings can provide insights into their performance.

- Safety and Compliance: Ensure that the carrier adheres to safety regulations and has a strong safety record. Compliance with international shipping laws is essential for avoiding legal issues.

- Technology and Tracking Capabilities: Advanced tracking systems can enhance visibility throughout the shipping process. Opt for carriers that offer real-time tracking and proactive communication regarding shipment status.

Best Practices for Selecting an International Shipping Company

To optimize your carrier selection process, consider implementing these best practices:

- Conduct Thorough Research: Gather information about potential carriers through industry forums, peer recommendations, and online reviews.

- Request Proposals: Reach out to multiple carriers for quotes and service proposals. This will help you compare offerings effectively.

- Perform Trial Runs: Before committing to a long-term contract, conduct short-term agreements with selected carriers to evaluate their service quality.

- Establish Clear Communication Channels: Maintain open lines of communication with your chosen carrier to address any issues promptly and ensure alignment on expectations.

- Regularly Review Performance: Continuously monitor carrier performance metrics such as delivery times and customer feedback. This will help you identify areas for improvement or potential changes in partnerships.

Common Mistakes to Avoid

When selecting an international shipping company, be mindful of these common pitfalls:

- Focusing Solely on Cost: While pricing is important, prioritizing the cheapest option over quality can lead to service disruptions.

- Neglecting Carrier Specialization: Different carriers may specialize in various types of cargo or regions. Ensure that the carrier’s expertise aligns with your specific needs.

- Ignoring Customer Feedback: Disregarding reviews or references from other businesses can result in overlooking critical insights into a carrier’s reliability.

Conclusion

Selecting the right international shipping company is essential for enhancing your logistics operations and ensuring customer satisfaction. By considering key factors such as service offerings, reliability, pricing, and technology capabilities, you can make an informed decision that supports your business goals. Implementing best practices in carrier selection will further streamline your shipping processes and foster strong partnerships in the dynamic world of international trade.

FAQs

1. What should I look for in an international shipping company?

Look for service offerings, experience in your industry, pricing transparency, reliability, geographic coverage, safety compliance, and technology capabilities.

2. How can I ensure that my chosen carrier meets my needs?

Conduct thorough research, request proposals from multiple carriers, perform trial runs before committing long-term, and regularly review their performance metrics.

3. What are some common mistakes to avoid when selecting a shipping company?

Avoid focusing solely on cost, neglecting specialization requirements, ignoring customer feedback, and failing to establish clear communication channels with your chosen carrier.